🧭 Introduction

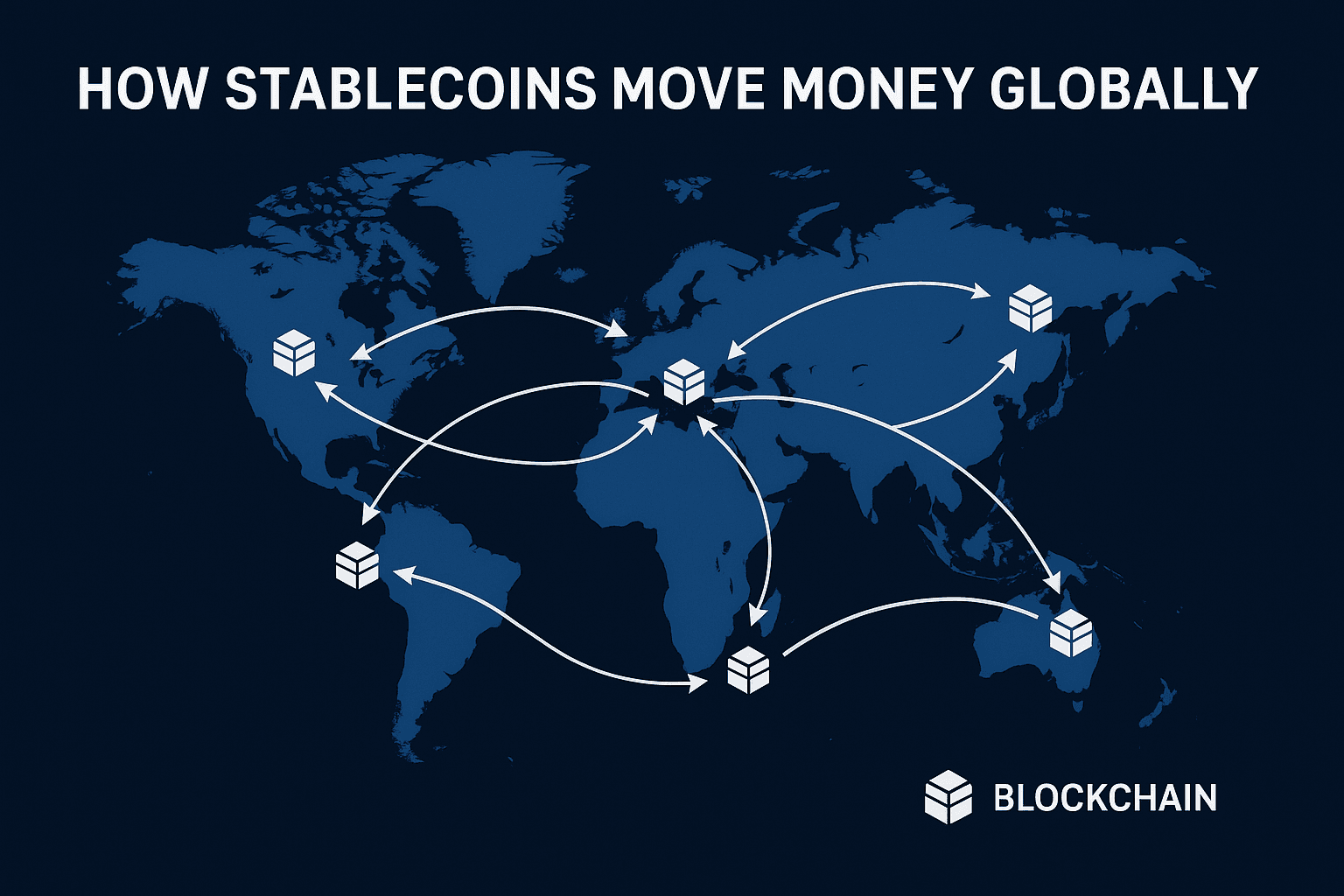

What used to take 3 days and $30 in fees now takes 3 seconds—and costs less than a coffee.

Welcome to the new era of cross-border payments, powered by stablecoins.

From Silicon Valley to Dubai, stablecoins like USDC and USDT are no longer niche—they’re becoming the default rails for instant, secure, and transparent international money transfers.

As central banks, payment networks, and startups race to modernize legacy systems, stablecoins are leading the charge—quietly transforming how the world moves money.

🔍 What Are Stablecoins—and Why Do They Matter?

Stablecoins are digital currencies pegged to a stable asset, typically the US dollar, Euro, or gold.

Unlike Bitcoin or Ethereum, their value remains constant, making them:

- Ideal for payments

- Less volatile than other crypto assets

- Easier to regulate and integrate

The most common types:

- 💵 USDC – Issued by Circle, regulated and widely used

- 💵 USDT (Tether) – Largest by volume, used in global trading

- 💰 PYUSD – PayPal’s own stablecoin focused on enterprise and cross-border commerce

🌐 How Stablecoins Are Reinventing Cross-Border Payments

Traditional international payments run through:

- Multiple banks (correspondent banking)

- 1–5 day settlement times

- High FX fees + hidden middlemen

Stablecoins eliminate this by using blockchain rails that: ✅ Settle instantly

✅ Cost less than $0.01

✅ Work 24/7 globally

✅ Don’t rely on banking hours or intermediaries

For freelancers, remote workers, SMBs, and international vendors—this is revolutionary.

🏦 Big Players Betting Big on Stablecoins in 2025

🔵 Circle & USDC

- Launched the Circle Payments Network to link banks, wallets, and fintech apps via USDC

- Backed by BlackRock, Goldman Sachs

- Actively integrated with Visa, Shopify, and Plaid

🟣 Tether (USDT)

- Dominant in volume (~$100B+)

- Trusted in emerging markets where fiat systems are broken

- Used heavily in Asia, Africa, and MENA for P2P transfers

🟡 PayPal (PYUSD)

- Bridging crypto + traditional finance

- Offers business-focused global payouts

- Targeting enterprise and retail cross-border flows

🏛️ The Regulation Shift: From Grey Zone to Green Light

Governments and regulators are warming up to stablecoins in 2025:

- The U.S. Stablecoin Act is expected to pass mid-year, providing legal clarity

- The UAE Central Bank and Bahrain are exploring stablecoin sandbox licenses

- MiCA (Europe) now allows licensed stablecoin issuance across the EU

This clarity is attracting banks, PSPs, and remittance players to integrate stablecoins into their tech stacks.

💸 Real-World Use Cases (Already Working)

🧑💻 Freelancers in Pakistan or Kenya → Paid in USDC instantly

🛍️ E-commerce brand in Dubai → Pays Chinese supplier in USDT

💼 Corporate in the UK → Uses Circle’s API to send payroll globally

🌎 NGOs in Africa → Disburse aid directly to wallets via PYUSD

No banks. No delays. No FX games.

🔐 But Is It Safe? The Risks to Watch

Despite growth, stablecoins still carry some risks:

- Regulatory uncertainty in some regions

- Need for strong asset backing transparency

- Smart contract vulnerabilities on certain blockchains

✅ Best practices:

- Stick to regulated, audited stablecoins (USDC, PYUSD)

- Avoid lesser-known stablecoins with no reserve proof

- Use whitelisted wallets and KYB-compliant services

🔮 What’s Next for Stablecoins & Global Payments?

💡 Stablecoins won’t replace banks—they’ll run under them.

Expect to see:

- Stablecoin APIs built directly into online banking

- Wallets offering instant swap between stablecoins and fiat

- Central Bank Digital Currencies (CBDCs) coexisting with stablecoins

- GCC-based fintechs launching Dirham-backed stablecoins for regional payments

In short: Stablecoins will become invisible infrastructure—just like internet packets.

🧠 Final Thoughts from Trendzdesk

Stablecoins are quietly disrupting the $150 trillion global payments industry—not by making noise, but by making money move faster, cheaper, and smarter.

For fintech founders, banks, and creators building in the payment space, ignoring stablecoins in 2025 isn’t an option—it’s a liability.

If you’re looking to launch a payment app, remittance platform, or crypto wallet—start with stablecoins at the core.

Because the future of money doesn’t sleep—and it’s already moving on-chain.