✅ Introduction

In fintech, money isn’t your biggest asset—data is.

In 2025, the most successful fintech startups aren’t just building apps—they’re building data engines.

From how users spend to when they save, fintech platforms generate millions of data points every day.

And that data? It’s not just for dashboards. It’s fuel for product innovation, investor attraction, and direct monetization.

Let’s break down why data is the new currency in fintech—and how you can ethically and profitably monetize it.

🧠 Why Data Is the Heart of Fintech

1. Behavioral Insights Drive Better Products

Fintech platforms know:

- When people get paid

- What they buy

- How often they save or invest

- What makes them churn

This allows them to build personalized features, create smarter onboarding flows, and target segments surgically.

Example: A digital wallet sees a user pays school fees in January → It recommends education savings plans in November.

2. Data Powers Fraud Detection & Risk Management

AI algorithms trained on historical fraud data can:

- Detect unusual patterns instantly

- Score transactions in real time

- Flag high-risk users before onboarding

Startups like Featurespace, Taktile, and Feedzai are building risk models using transaction-level and behavioral data.

3. Personalization = Retention

The more your fintech app knows about a user, the more relevant, timely, and sticky it becomes.

Think: investment tips based on user risk tolerance, budgeting nudges after overspending, or credit builder tools when scores drop.

Personalized UX = more trust → longer retention → higher lifetime value.

💸 How to Monetize Fintech Data (Ethically)

Monetizing user data doesn’t mean selling it to brokers (which violates privacy laws). It means using insights to create new revenue streams that also deliver value.

Here are 5 smart ways:

1. Insight-as-a-Service (IaaS)

Package anonymized data insights and offer them to:

- Retail brands

- Credit bureaus

- Financial institutions

- Research firms

Example: A GCC-based neobank offers insight dashboards to real estate developers showing rent payment trends in Dubai.

2. Hyper-Personalized Financial Products

Use customer data to:

- Offer custom lending rates

- Create dynamic insurance pricing

- Recommend investment portfolios that adapt in real time

Apps like Nubank and YAP do this to boost user conversion and offer “Netflix-style” money experiences.

3. Data-Driven Affiliate Offers

Offer embedded financial products (credit cards, buy-now-pay-later, insurance) at the right time, powered by user data.

A user pays for international flights → offer travel insurance or global prepaid card immediately.

You earn affiliate revenue only when it’s relevant.

4. AI-Powered Premium Tiers

Add AI-driven tools as paid add-ons:

- Smart budget forecasts

- Credit coaching

- Advanced risk scores

Users pay monthly for actionable insights they can’t get elsewhere—generated from their own data.

5. Secure Data Exchanges

For larger fintechs: Join decentralized data marketplaces where permissioned, encrypted data sets are traded for research or AI model training.

Key platforms: Ocean Protocol, Gaia-X (EU), and soon-to-launch regional data hubs in UAE and Saudi Arabia.

🛡️ Privacy & Compliance: Don’t Cross the Line

Data monetization must follow GDPR, UAE’s Personal Data Protection Law, and financial compliance standards.

Always:

- Anonymize and aggregate data

- Get user consent where needed

- Use data to enhance value, not exploit it

Trust is currency. Without it, your data play dies.

🧮 How Startups Can Start Small

If you’re a fintech startup or founder:

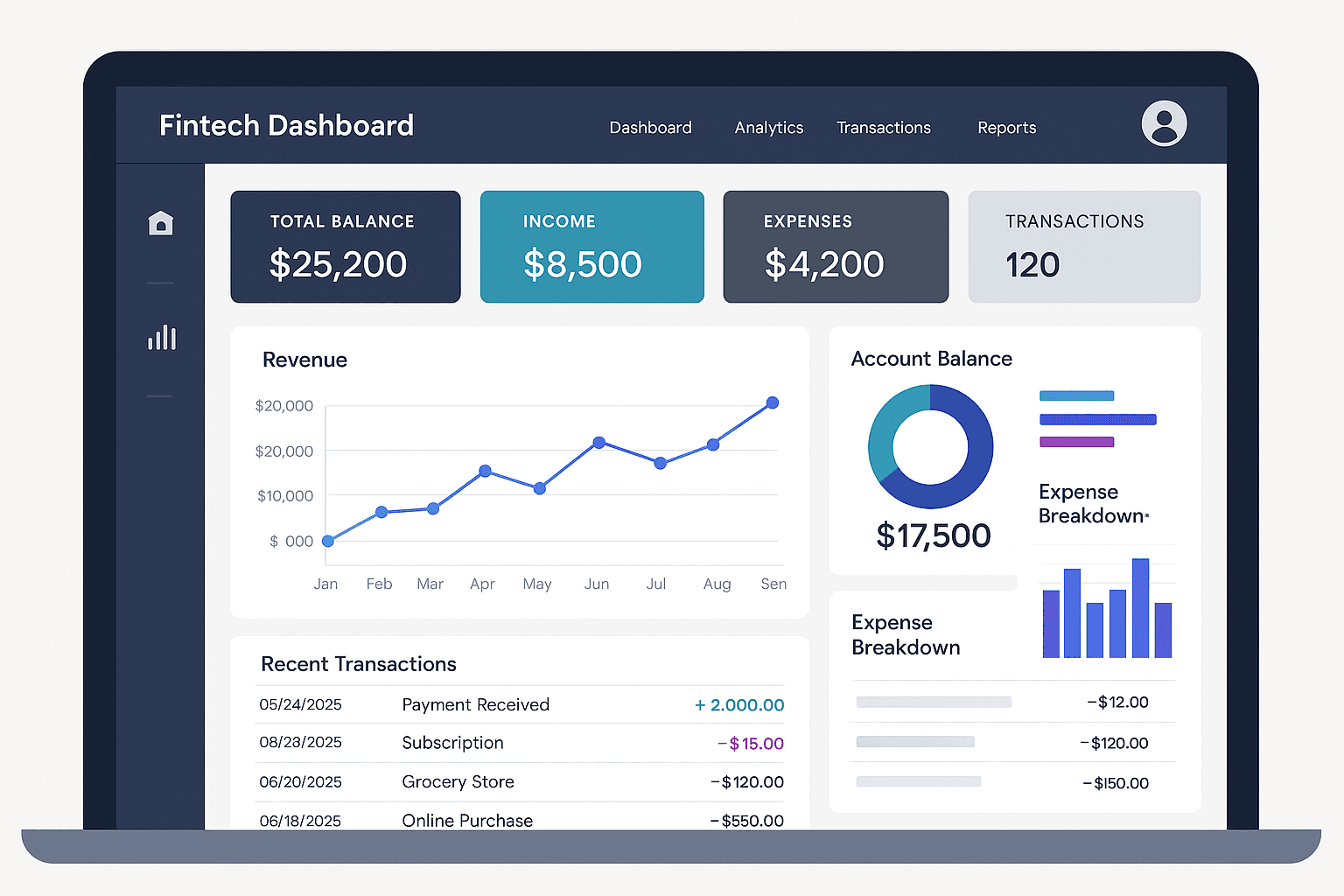

- Set up clean, structured analytics from day 1

- Tag user behaviors and actions across your app

- Use tools like Mixpanel, Segment, or Metabase

- Build internal dashboards with high-level insight buckets

Then, test monetization through:

- Premium insights

- Embedded offers

- Data-driven partnerships

🔮 Future of Data in Fintech

In 2025 and beyond:

- Open Banking will expand data portability

- Decentralized ID will give users control of their own data

- AI agents will personalize entire financial lives in real time

Fintechs that understand this shift—and treat data as a strategic asset—will be the ones dominating the next decade.